The Indian rupee is projected to trade within a narrow band of 85.25 to 86.25 against the US dollar in the near future, according to a recent economic outlook from the Bank of Baroda (BoB). While the domestic currency has shown relative resilience, the report warns that it remains exposed to risks stemming from heightened geopolitical tensions and potential shifts in US trade policy.

“We expect INR to trade in the range of 85.25-86.25/USD in the near-term. Risks remain from a significant escalation in geo-political tensions,” the BoB report stated.

June Sees Sharp Volatility

The rupee has weakened by 0.6 per cent so far in June 2025, following a 1.3 per cent slide in May. Notably, the rupee experienced its steepest single-day drop in a month on June 13, falling by 0.6 per cent after reports surfaced of Israeli military action against Iran. Prior to that, the currency had been relatively stable, fluctuating between 85.39 and 85.63 from June 2 to June 12.

Although the rupee has since regained some stability, it continues to trade above the 86-mark against the dollar.

US Dollar Weakness Supports Global Currencies

Globally, several currencies gained in June, largely due to a softer US dollar. The dollar index (DXY) slipped by 1.3 per cent, driven by US economic indicators that showed easing inflation and mixed signals in the labour market. These developments have prompted market expectations that the US Federal Reserve may lower interest rates later this year. The probability of a rate cut in September has risen to around 60 per cent, up from approximately 50 per cent the previous month.

RBI Reserves Offer Cushion

Despite looming external risks, the rupee has shown relative stability, in line with global currency movements. According to the BoB report, India's strong foreign exchange reserves continue to provide a robust buffer that can help manage any volatility. While global uncertainties and the expiry of current US tariff pauses may influence sentiment, the rupee is expected to remain within the projected range if current trends persist.

-

CBFC Asks Sitaare Zameen Par Makers Asked To Replace 'Michael Jackson' With 'Lovebirds', Add PM Modi's Quote In Film

-

'Zero Shame & Empathy': Raveena Tandon SLAMMED For 'Tone-Deaf' Post Supporting Air India Days After Ahmedabad Plane Crash

-

BPSC 71st Recruitment 2025: Vacancies Increased To 1,264; Check Details Here

-

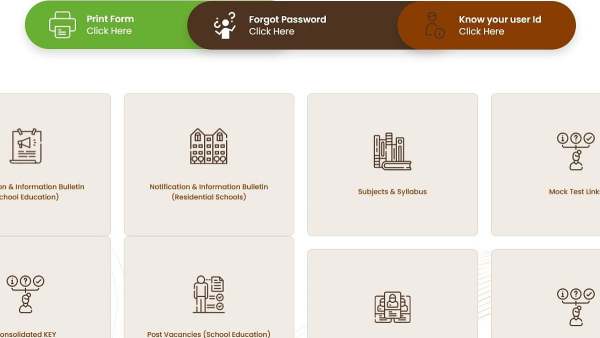

AP DSC 2025 Response Sheets Likely To Be Released Today For 16,437 Teacher Posts; Check Details

-

'Vibe Hai': PM Modi And Italian Counterpart Shake Hands And Exchange Smiles At G7 Summit; Netizens React To 'Melodi Moment'