Compressed Natural Gas (CNG) could continue to grow as an auto fuel in India, even as electric vehicle (EV) adoption gathers pace across key states, according to a recent report by Nomura.

The report highlighted that state governments, especially Delhi and Mumbai, are expected to roll out aggressive EV policies to address the problem of rising air pollution. While this could put some pressure on the growth of CNG, analysts believe both fuel types could still co-exist in the coming years.

It stated, "CNG as an auto fuel could grow alongside EVs.... EV policies by states to continue pressuring CNG growth."

The report added that Delhi, which had already banned diesel vehicles older than 10 years nearly a decade ago, may now consider placing restrictions on CNG vehicles as a next step in its clean fuel transition.

The state is seen to be intensifying its focus on cleaner mobility solutions to tackle worsening air quality.

In contrast, Mumbai, being a coastal city, usually records better air quality index (AQI) levels. In the short term, the EV policy focus in Mumbai could shift more towards reducing the use of liquid fuels like petrol and diesel, rather than targeting CNG.

The report noted that this could work as a policy tailwind for both CNG and EV adoption in Mumbai.

Further, the report mentioned that the ongoing High Court-monitored committee on EV adoption in Maharashtra includes participation from Mahanagar Gas Limited (MGL), a key supplier of CNG in the region.

During its recent investor day, MGL's management expressed confidence that CNG could benefit under the state's upcoming EV policy. The company sees potential in policies that promote a multi-fuel transition instead of focusing only on electric vehicles.

The report also pointed out another key development that could benefit gas suppliers, the possible inclusion of natural gas under the Goods and Services Tax (GST) regime.

Currently, natural gas is subject to a combination of state VAT, central excise duty, and central sales tax. Moving it under GST would simplify the tax structure by eliminating these cascading taxes and potentially lowering the overall tax burden for businesses.

-

Not everyone needs magnesium supplements: Here's who should skip it

-

Before the monsoon arrives, put this white thing worth 2 rupees in the wheat drum, it will protect it from mites and fungus

-

Your electricity bill will not exceed 200 units, just do this work daily

-

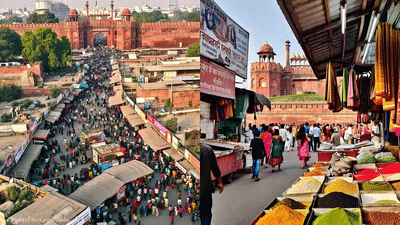

Chandni Chowk was built for the princess who loved shopping, have you ever wondered how this market got this name

-

Why are rubber tubes hung near truck tyres? It is guaranteed that you will not know the answer