Select stocks including Chalet Hotels, Swiggy, Siemens Energy India, SJS Enterprises, International Gemmological Institute, Happy Forgings, Page Industries, Interarch Building Solutions and Sansera Engineering have seen fresh interest from the various brokerage firms, who have recently initiated their coverage on these companies.

The host of brokerages including YES Securities, IIFL Securities, HDFC Securities, Elara Capital, Kotak Institutional Equities, ICICI Securities, JM Financial, Aditya Birla Money and B&K Securities have launched their maiden reports on these stocks. Barring Page Industries and International Gemmological Institute, all stocks have 'buy' ratings on them with an upside potential of 50 per cent. Here's what brokerage said on these stocks:

YES Securities on Chalet Hotels

Rating: Buy | Target Price: Rs 1,080 | Upside Potential: 21%

We initiate coverage on Chalet Hotels with a 'buy' rating based on strong growth prospects on account of strong presence in key metro markets; robust expansion pipeline; presence in commercial real estate; healthy balance sheet which allows company to pursue incremental growth opportunities; and addition of leisure portfolio opens new avenue for growth, said YES Securities.

"Chalet hotels has proved its expertise as an asset owner and developer over the years and we expect it to be the key beneficiary of the ongoing industry upcycle. We value the company at FY27E EV/EBITDA multiple of 25 times and arrive at target price of Rs 1,080," it added.

Advertisement

IIFL Securities on Swiggy

Rating: Buy | Target Price: Rs 535 | Upside Potential: 50%

Swiggy is India’s second-largest food tech company, with food delivery (FD), quick commerce (QC), and other verticals. Swiggy may deliver 28 per cent revenue CAGR over FY25-28ii and become Ebitda/PAT positive by FY27ii/28ii. Swiggy is potentially 7/5 quarters behind Eternal in FD and 3/8 quarters behind in QC on GOV/Ebitda margins respectively, said IIFL Securities.

"We see this as a function of slower execution in the past rather than a competitive disadvantage. We believe successful execution in QC could provide asymmetric upside in the stock, with easing competition in QC and market share gains in FD as key catalysts. We initiate coverage on Swiggy with a BUY rating and a target price of Rs 535," it added.

Advertisement

HDFC Securities on Siemens Energy India

Rating: Buy | Target Price: Rs 1,080 | Upside Potential: 10%

Siemens Energy captures the maximum value among its peers as it has products/solutions covering a larger market size, viz, decarbonization, power generation, power evacuation, grid automation, EPC services, and clean energy like green hydrogen and battery storage. Ihis has been a highly profitable business for Siemens India which has clocked 22.6 per cent Ebitda margin for H1FY25, said HDFC Securities.

"Its robust order backlog of Rs 15,000 crore lends strong growth visibility. With the demerger, SEIL becomes a power pure play with exclusive rights for some South Asia countries. Given the strong cash flows, robust order book, limited competitive intensity, and export opportunities, we rate SEL as a 'buy' with a target price of Rs 3,000 apiece,

Elara Capital on SJS Enterprises

Rating: Buy | Target Price: Rs 1,710 | Upside Potential: 36%

The premium multiple echoes differentiated aesthetics, industry leading return ratios (FY28E ROCE/ROE at 23.5 per cent/19.4 per cent), and capital-efficient expansion into high value, export-ready verticals, said Elara Capital. It cited a concentrated customer base, and missteps in scaling export and integrating acquisitions as key risks.

"Despite better earnings visibility and margin leadership, SJS trades at a discount to premium peers at 11.3 times FY28E EV/Ebitda and 18 times FY28E P/E; thus, a strong rerating opportunity, as integration gains and export scale-up unfold. We value SJS on 30 times one-year forward EPS of Rs 56.9, with target price at Rs 1,710," it added.

Advertisement

Kotak Institutional Equities on International Gemmological Institute

Rating: Reduce | Target Price: Rs 375 | Upside Potential: 4%

IGIL is the world’s second-largest diamond certification company, with a 65 per cent volume share in LGD certification. IGIL’s exposure to the fast-growing LGD market is promising, but concerns about the sustainability of pricing and profitability, as well as long-term relevance of LGD certification, warrant a cautious valuation approach, said Kotak Institutional Equities with a reduce rating and a target price of Rs 375.

ICICI Securities on Happy Forgings

Rating: Buy | Target Price: Rs 1,080 | Upside Potential: 21%

Happy Forgings (HFL) is a leading manufacturer of complex, heavy-forged and precision-machined components. Its focus on enhancing its capabilities has helped expand the company’s product portfolio and customer base across diverse segments and geographies. This has enabled HFL to consistently outperform the underlying industry, said ICICI Securities in IC report.

Given HFL’s current scale and a large addressable global opportunity, especially owing to the shifting global landscape, we see a long-term runway for growth. With 20 per cent pre-tax RoCE, we expect HFL to deliver 13 per cent earnings CAGR during FY25–28E despite a muted outlook for the underlying industry," it added and initiated coverage with a 'buy' rating and target price Rs 1,150.

Advertisement

JM Financial on Page Industries

Rating: Hold | Target Price: Rs 45,000 | Upside Potential: -1%

The innerwear market suggests that it has grown only at 6 per cent CAGR over FY19-25 to Rs 78,500 crore, with share of the organised segment growing to 45 per cent in FY25. We expect the organised innerwear market to grow at 10 per cent over FY25-28E and organised men’s innerwear to grow at 7 per cent and women’s innerwear to grow at a higher 11 per cent, said JM Financial.

"In the women’s segment, despite low penetration levels of 9 per cent, growth is likely to be limited because it is largely perceived as a men’s wear brand and has only core product offerings. On the other hand, its high-growth athleisure segment has witnessed moderation in growth with huge competition from apparel and unorganised players," it said with a 'hold' and target price of Rs 45,000.

Aditya Birla Money on Interarch Building Solutions

Rating: Buy | Target Price: Rs 2,650 | Upside Potential: 34%

Interarch Building Solutions (Interarch) is the second-largest player in India’s rapidly growing pre-engineered building (PEB) solutions industry, with a production capacity of 1,61,000 MTPA. The company operates four integrated manufacturing plants in the states of Uttarakhand, Tamil Nadu & Andhra. Its current order book stands strong at ₹1,646 crore, as on April 30, said AB Money.

Advertisement

"Interarch aims to close the gap with market leader Kirby Building Systems, targeting a capacity increase to 2,00,000 MTPA by FY26 & 2,40,000 MTPA by FY27–28, with further additions beyond that timeline. We project a revenue, Ebitda and profit CAGR of 21 per cent, 24 per cent and 20 per cent over FY25–27," it added with a 'buy' rating and a target price of Rs 2,650.

B&K Securities on Chalet Hotels

Rating: Buy | Target Price: Rs 1,601 | Upside Potential: 24%

We initiate coverage on Sansera Engineering (SANSERA) with a 'buy' rating considering FY25 -27E revenue CAGR of 17 per cent and improvement in Ebitda margins to 18 per cent due to scale and diversification to high margin non-auto components, improvements in RoCE/RoE to 14 per cent/12 per cent and a strong balance sheet, said B&K Securities.

"Sansera presents an attractive long-term investment opportunity, backed by strong revenue visibility across segments, diversified product portfolio and entry into high-margin segments. Sansera has a strong global presence with 32 per cent of revenue and 52 per cent of the order book from the overseas markets across both auto and non-auto segments," it said initiating coverage with a 'buy' and a target price of Rs 1,601.

-

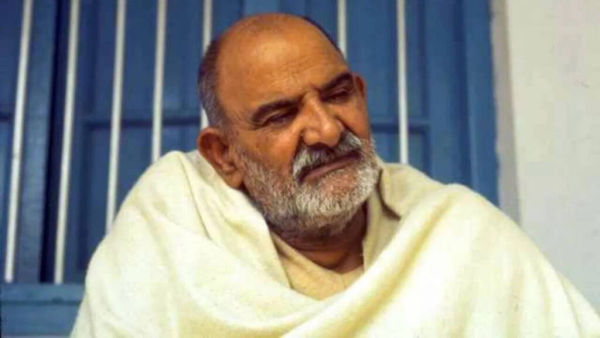

Neem Karoli Baba is not called the incarnation of Hanumanji, this is his 3 big miracles

-

Apple’s back to school offer goes live in India: Get airpods, magic keyboard for free on Purchasing … | Technology news

-

ISL: The future of Indian Super League is in danger, this decision of AIFF stirred the Indian football world

-

Dallas Cowboys Cheerleaders Receive Huge 400% Pay Bump

-

Lens in contract extension talks with veteran attacker