Everyone is worried about the future of their child. Parents save for this and also want to increase that money by investing. Although there are many investment schemes in the market for children, the recently launched NPS Vatsalya Scheme is considered to be the best among all of them. This scheme provides the benefit of compound interest, due to which even your small amount can create a fund of crores after a long time.

Under the NPS Vatsalya scheme, accounts can be opened for children below 18 years of age. If you open this account immediately after the birth of the child, then till the age of 18 years it will be considered an account under Vatsalya Yojana and after that, this account will become a normal NPS account. However, both types of accounts get the benefit of compound interest.

How to create a fund of 11 crores

Under the scheme, to create a fund of Rs 11 crore, you will invest Rs 10,000 per year, in which about Rs 834 will be deposited every month. This amount can be invested till the age of 18 years. After this, the account turns into a normal NPS account and this amount keeps increasing till the age of 60 years.

How much investment in 18 years

If you deposit Rs 10,000 every year in the name of the child, then a total of Rs 1.80 lakh will be invested in 18 years. If you get a return of 10 percent every year on this investment, then in 18 years this money will increase to about Rs 5 lakh. However, if we look at the data of the last 20 years, then NPS has a return of about 12.80 percent. Now from the age of 18 to the age of 60 lakhs, you will keep getting interest on your investment and there will be no need to invest any money further.

How much money will be created by the age of 60

As we told you, if you have opened an account in the name of a newborn baby and you get 10% interest on your investment till the age of 18, then a fund of 5 lakhs will be ready. Now you will keep getting interest on this 5 lakh rupees till the age of 60 without any investment and if you get a return of 10% on it, then a fund of 2.75 crores can be created by the age of 60. However, as per the data of 20 years, if you get a return of 12.86%, then the fund of 5 lakh rupees can grow to 11.05 crores.

What should be the investment strategy?

To create a big fund, you will have to choose the aggressive (75% equity) option. In this, you will have to invest 75% of the money in equity, so that you can get a big fund according to the market. Looking at the record of the last 20 years of NPS, an average return of 11.59% has been received with 50% equity, 30% corporate debt, and 20% investment in government securities. If the equity investment is increased to 75%, then the return can be up to 12.86%.

How to open a child's account

Visit the NPS website.

Click on Register Now under the NPS Vatsalya (Minors) tab.

Enter the guardian's date of birth, PAN, mobile number, and email.

Start registration after OTP verification.

Upload minor and guardian details, and required documents.

Make an initial investment of a minimum of Rs 1,000.

Open an account by registering yourself through double OTP or eSignintre.

When can you withdraw money from the account?

After the lock-in period of 3 years, the guardian can withdraw up to 25% of the amount for education, critical illness, or disability of more than 75%, which can be withdrawn three times in the entire period. At the age of 18, the account converts to a normal NPS account. At this time at least 80% of the corpus must be used to buy an annuity, the remaining 20% can be withdrawn in cash. If the total corpus is less than Rs 2.5 lakh, the entire amount can be withdrawn.

Disclaimer: This content has been sourced and edited from News 18 hindi. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Ashwin's Wife Pens Emotional Note As IND vs ENG Test Series Begins

-

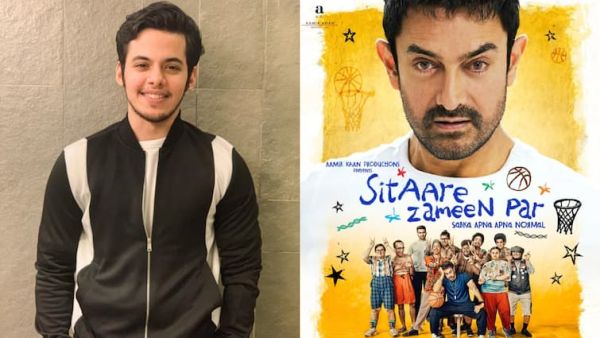

Darsheel Safary Pens Emotional Review For Aamir Khan's Sitaare Zameen Par

-

This 2-hour 15-minute thriller will send chills down your spine, more thrilling than Drishyam and Andhadhun, lead actors are…

-

Meet actress who started working at 12, became a mother at 20, married twice, was abused by…, her name is…

-

Remember Frooty from Son Pari? Here’s how she looks now, know what she’s doing these days