This guide explains how to read an option chain in the Indian context, offering clear examples and practical steps to help retail traders make better decisions.

What an Option Chain Shows

An option chain lists all available call and put options for a given security or index, organised by strike price and expiry date. Each row corresponds to a strike price, and columns display key data such as:

- Bid/Ask prices

- Last Traded Price (LTP)

- Volume and Open Interest (OI)

- Implied Volatility (IV)

On most platforms, calls appear on one side and puts on the other. This layout lets you compare options side by side and evaluate potential trading strategies quickly.

Spotting Liquidity and Support/Resistance

Liquidity is critical, especially in F&O trading. High volume and tight bid-ask spreads mean you can enter and exit trades more efficiently.

Take, for instance, if the 18,000 call shows both high OI and volume. This suggests strong interest; that level can act as resistance if prices approach it. Similarly, large OI in a put strike often marks a support zone.

Understanding Open Interest and Its Change

Open interest shows the number of outstanding contracts. A rising OI alongside rising prices suggests fresh long positions; if prices fall as OI rises, shorts are likely being created.

Consider that Bank Nifty is trading at 47,200. Seeing increasing OI and premiums at the 47,500 call strike suggests bullish sentiment—traders expect an upward breakout.

Using Implied Volatility to Gauge Sentiment

Implied volatility (IV) reflects expectations of future price swings. High IV means the market anticipates sharp moves, whereas low IV suggests calm.

Before major events like RBI policy announcements, IV often rises, making premiums more expensive—ideal for selling strategies. After the event, IV crush occurs, and premiums drop.

For example, if Nifty’s IV jumps before a budget, a trader might sell an Iron Condor to profit from the expected drop in volatility after the event.

Spotting Smart Money and Unusual Activity

Unusual spikes in volume or open interest often hint at institutional moves. Looking at an option chain, if a deep out-of-the-money option suddenly shows activity, it could signal hedging or speculative bets by big players.

Once, a surge in OI at a 48,000 Bank Nifty call—despite no price action—indicated institutional bullishness. Those who noticed it secured exposure ahead of the next upmove.

Strike Selection: ITM, ATM and OTM

Understanding the moneyness of strikes helps you select trades suited to your outlook.

- In the Money (ITM) options have intrinsic value.

- At the Money (ATM) options have strikes near the current price—most liquid.

- Out of the Money (OTM) options are speculative but cost less

Example: Nifty at 18,000:

- 17,800 calls are ITM

- 18,000 strikes are ATM

- 18,200 calls are OTM

Choose based on your bias—near strikes for directional plays or far strikes for leverage.

Combining Volume, OI and Price Action

To get a clearer picture, always interpret volume and open interest in context. A volume surge without OI change suggests short-term churning. If both rise, new capital enters the trade.

Scenario: If the 18,200 call shows rising OI, rising price, and increased volume, it’s a sign of a genuine bullish trend.

Real Life Example: Nifty Option Chain

Suppose Nifty trades at 18,000 and you see:

- 18,200 call: OI 50,000, +5,000 today; volume high.

- 17,800 put: OI 45,000, −2,000 today; volume average.

This suggests a bullish bias: fresh longs at 18,200 call and short covering in puts.

Strategy:

- Buy 18,200 call for directional play,

- Alternatively, sell 17,800 put as part of a credit spread with tight stop-loss.

Managing Risk and Time Decay

Remember that theta, or time decay, eats into option values as expiry nears. Options close to expiry decay faster, which benefits sellers but hurts buyers.

Combine theta with IV:

High IV + short-term expiry = favorable conditions for selling premium.

Low IV + long expiry = suitable for buying straddles or ratio spreads.

Steps to Read an Option Chain

Common Pitfalls to Avoid

- Ignoring IV: High premiums may reflect expected volatility.

- Following OI alone: Always pair it with price and volume trends.

- Late entries: OI clues appear earlier; act before full move occurs.

- Overtrading: Not every movement warrants a trade. Patience beats noise.

Conclusion: Sharpen Your F&O Trading with Option Chains

Mastering the option chain is essential for improved F&O trading. By studying open interest, volume, implied volatility and strike placement, you gain early insight into market sentiment and institutional flows.

With disciplined application, you’ll detect support/resistance levels, spot bull/bear behaviours before they unfold and choose trade entry points with higher confidence. Practice this regularly, and you'll be well-placed to transform raw data into smart, actionable trades.

-

Ashwin's Wife Pens Emotional Note As IND vs ENG Test Series Begins

-

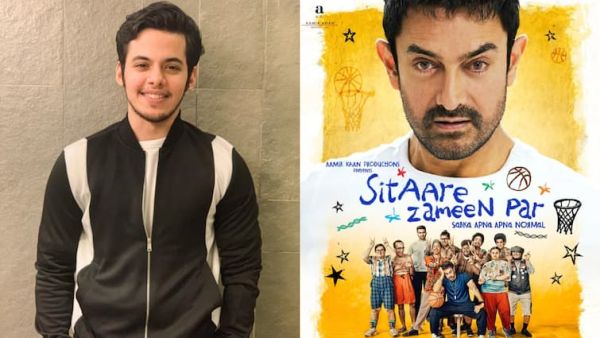

Darsheel Safary Pens Emotional Review For Aamir Khan's Sitaare Zameen Par

-

This 2-hour 15-minute thriller will send chills down your spine, more thrilling than Drishyam and Andhadhun, lead actors are…

-

Meet actress who started working at 12, became a mother at 20, married twice, was abused by…, her name is…

-

Remember Frooty from Son Pari? Here’s how she looks now, know what she’s doing these days