Whirlpool Corp is likely to divest a 31% stake in its Indian arm over global restructuring after a $1.5 billion loss. Indian big players like Reliance Retail Havells India and buyout funds like EQT and Bain Capital are interested in this share as reported by Economic Times. Whirlpool wants to raise $550-600 million. Reliance Retail and consumer appliances major Havells India will compete with other bulge-bracket buyout funds to acquire a controlling interest in Whirlpool of India. It is the locally listed firm of the Michigan-based company that was once the world’s largest appliance maker by sales. Other financial sponsors EQT and Bain Capital are also shortlisted after the initial round of screening. Whirlpool Corp Divesting Plan Whirlpool Corp is looking to sell 31% stake in Whirlpool of India which generates 85% of its Asia revenue. They will retain a 20% equity stake in the company. The equity in India is held through Whirlpool Mauritius Ltd. This exercise is part of a global reorganisation started by the company in 2022 in the US after its KitchenAid and Maytag products reported a $1.5 billion loss. It has already reshaped its global portfolio operations in other Asian markets and also in some parts of Europe. Whirlpool Corp is also trying to cut costs and its workforce. Why Is Whirlpool Corp Divesting? The company is also focusing on selling smaller home appliances like blenders and coffee makers. The company reportedly said it is keen to raise net cash proceeds of $550-600 million (Rs 4684-5110 crore) from the transaction. They will also give an open offer for an additional 26% stake from public shareholders of the company. If it is fully subscribed to the incoming investor may own around 57% of the company.

-

Where to try best Mexican food in Hyderabad: Top 5 picks of 2025

-

Indian govt using 9 of 11 FBI-listed tactics of transnational repression: IAMC

-

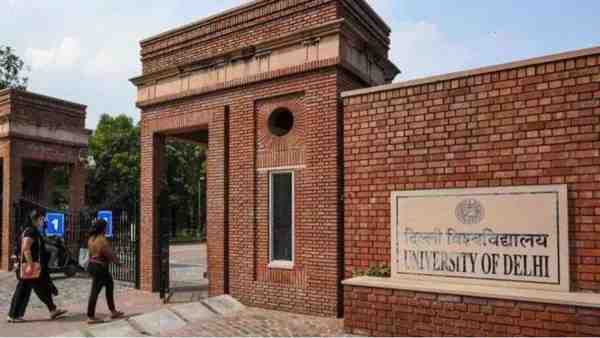

Delhi University under fire for calling religion a language, dropping Urdu

-

UP police file case against imam for collecting donations for Palestine

-

Karun Nair Ends 3005-Day Test Wait, Registers Unique Record