India’s gross direct tax collections for the financial year 2025–26 have reached approximately Rs 5.45 lakh crore as of June 19, reflecting a 4.86 per cent year-on-year increase, according to figures released by the Income Tax Department. During the same period last year, gross collections had stood at around Rs 5.19 lakh crore.

Despite the uptick in gross collections, net direct tax revenues recorded a slight dip of 1.39 per cent, falling to Rs 4.59 lakh crore. This decline is largely attributed to a significant 58 per cent increase in tax refunds, which indicates both faster return processing and improved taxpayer services by the tax administration.

Advance Tax Trends

Advance tax payments, a key indicator of economic activity and business sentiment, reached Rs 1.56 lakh crore, representing a 3.87 per cent growth. This rise was primarily driven by a 5.86 per cent increase in corporate advance tax contributions, while collections from non-corporate taxpayers saw a 2.68 per cent decline. The data points to strong corporate compliance, even as individual and non-corporate contributions moderated slightly.

Notably, while corporate tax intake remained robust, Securities Transaction Tax (STT) collections registered a decline, contributing to a more subdued overall growth pace.

Easing Compliance Through Digital Measures

To enhance user experience and streamline payments, the Income Tax Department recently launched a new ‘e-Pay Tax’ feature on its official portal. According to the Central Board of Direct Taxes (CBDT), this tool is designed to simplify various compliance procedures for taxpayers.

Major Tax Reforms

In addition to operational updates, broader tax policy reforms are currently underway. In the July 2024 Union Budget, the government proposed a complete overhaul of the Income-tax Act of 1961 with the aim of simplifying and modernizing the tax code, reducing legal disputes, and bringing clarity for taxpayers.

As part of this effort, the government invited feedback from stakeholders on March 18, seeking public suggestions on the draft Income Tax Bill, 2025, which is presently under scrutiny by a Select Committee.

Finance Minister Nirmala Sitharaman, on March 25, confirmed that the new tax legislation will be tabled in the upcoming Monsoon Session of Parliament. The Finance Minister also reiterated during the Union Budget that individuals earning up to Rs 12 lakh annually will not have any tax liability, thanks to the enhanced rebate of Rs 60,000 under the revised tax regime.

-

Muscle-building foods you’re not eating—but should be

-

From thick hair to strong bones: 10 benefits of eating eggs daily

-

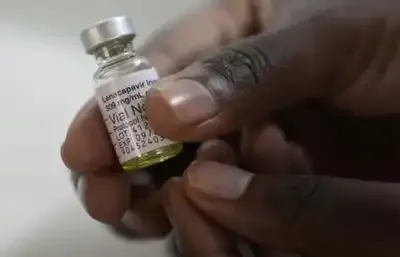

USFDA okays Lenacapavir: Affordable, generic India-made drug key to boost global HIV prevention

-

Don’t mix these 6 fruits together – Here’s why it may harm digestion

-

Neeraj Chopra Accomplishes Two-year First With Win Over Julian Weber in Paris Diamond League Event