US President Donald Trump has once again raised the possibility of removing Federal Reserve Chair Jerome Powell, a long-standing target of his frustration over interest rate policies.

In a post on Truth Social on Friday, Trump wrote, "I don't know why the Board doesn't override (Powell). Maybe, just maybe, I'll have to change my mind about firing him? But regardless, his Term ends shortly." The remarks reflect Trump’s continued discontent with Powell’s approach to monetary policy, reported Reuters.

Trump acknowledged that his repeated criticism might have complicated Powell's position, noting, "I fully understand that my strong criticism of him makes it more difficult for him to do what he should be doing, lowering Rates, but I've tried it all different ways."

Legal Uncertainty Over Firing Fed Chairs

Although Federal Reserve chairs are widely considered protected from presidential dismissal except for misconduct or malfeasance, Trump has regularly threatened to challenge that principle.

However, he has often contradicted these threats. Just days earlier, on June 12, he stated at the White House, "I'm not going to fire him."

Adding complexity to the matter, a Supreme Court ruling in May described the Federal Reserve as "a uniquely structured, quasi-private entity," which eased some concerns over whether Trump could legally dismiss Powell before his term concludes in May 2026. Despite Trump’s recurring threats, the legal foundation for removing a Fed chair remains uncertain and largely untested.

Fed Holds Rates Steady Amid Economic Concerns

On Wednesday, the Federal Reserve opted to keep interest rates steady, maintaining them in the 4.25 per cent to 4.50 per cent range. Alongside the decision, Fed officials projected a slowdown in economic growth, coupled with expectations of rising unemployment and inflation by year-end. This cautious outlook underscored the central bank’s balancing act between controlling inflation and sustaining economic momentum.

Fed Governor Chris Waller, often mentioned as a potential successor to Powell, indicated on Friday that rate reductions could be on the table as early as July. "With inflation coming down and the labour market showing signs of weakening, rate cuts should be considered as soon as July," Waller stated. Yet, during Wednesday’s meeting, Waller joined the rest of the Federal Reserve Board and the five voting regional bank presidents in a unanimous decision to maintain current rates, illustrating the Board’s tradition of reaching consensus. Significant dissent within the Fed remains uncommon.

Tariffs Add to Economic Debate

Part of Trump’s political appeal has rested on promises to tackle inflation, a goal he has pursued in part through tariff hikes during his time in office. Powell, however, has echoed widespread academic opinion by cautioning that such tariffs may end up driving consumer prices higher, potentially exacerbating inflation rather than controlling it.

As Powell’s term approaches its conclusion in May 2026, Trump is expected to announce a nominee for the Fed’s next chair in the coming months, setting the stage for another significant decision that could reshape US monetary policy in the years ahead.

-

Netflix star Sara Burack dead: Police arrest woman in connection with a fatal hit-and-run

-

Yoga the Indian Way: Unlocking Self-Realization and Lasting Inner Harmony

-

12 Easy Desk Exercises to Relieve Office Strain and Boost Posture During Work Hours

-

Healing Beyond the Physical: How Pranic Healing Addresses Invisible Emotional Wounds

-

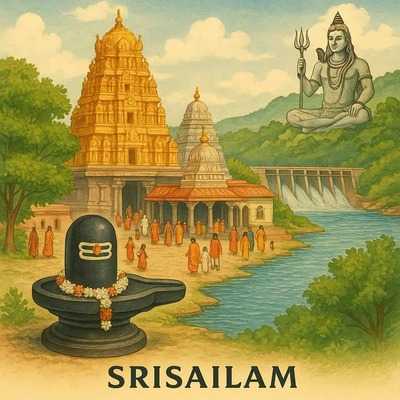

Visit this beautiful waterfalls just 4 hours away from Hyderabad