Most quick commerce firms deliver directly from their dark stores, employing delivery executives, demand forecasting, data analytics and an easy-to-use mobile app for customers, advantages local kirana stores find hard to afford.

Over the past two years, Indians have gotten hooked on the delivery of instant gratification. They are no longer stepping out of their houses to buy a toothbrush or simply bread from a nearby grocery. Everything is arriving at their doorsteps within 10-15 minutes, thanks to quick delivery firms like Zepto, Swiggy Instamart, Blinkit, and Amazon Now. Their rapid growth has not only changed consumer behaviour but also posed a threat to the businesses of kirana stores.

Most of these quick commerce firms deliver directly from their dark stores, employing delivery executives, demand forecasting, data analytics and an easy-to-use mobile app for customers, advantages local kirana stores find hard to afford. As per a 2024 report by Datum, the market share of kirana stores in India’s retail market dropped to 92.6% in 2023 from 95% in 2018. This number is further projected to drop to 88.9% by 2028. The report also showed that 46% of quick commerce users have reduced buying from kirana stores. More than 82% of the buyers have shifted at least 1/4th of their purchases from kirana stores to quick commerce platforms.

It has now become equally important for kirana stores to step up and embrace the changing times. Swiggy Instamart employs a hybrid model for its dark stores while also collaborating with kirana stores; firms like Kiko.live and Pincode are helping kirana stores compete in the times of quick delivery.

Nilaya Varma, Co-founder at Primus Partners India, explained that Kirana stores across India are no longer passive spectators; they’re actively evolving into micro quick-commerce hubs. “Many have instituted home delivery, digital payments, WhatsApp-based ordering, and basic inventory apps to meet modern consumer expectations. The willingness and demand are real. According to a survey, over 80% of kirana owners now believe digitising is essential, and around 84% have already begun integrating tech, even if modestly, into their operations,” he said.

Kuldeep Bhatti, owner of an organic grocery store, Easypick-Farmfresh, in East Delhi, onboarded on ONDC (Open Network Digital Commerce) through Kiko.live in January 2024. ONDC is a government-backed digital commerce initiative that has been working with many private players to help local MSMEs and sellers with online selling.

“Since I have got on the ONDC platform, I have got an additional 25-30% increase in my revenue,” said Bhatti.

“Since I have got on the ONDC platform, I have got an additional 25-30% increase in my revenue,” said Bhatti.

He had earlier tried to take orders through WhatsApp, but the process wasn’t structured. “What I did earlier was note down the numbers of all my customers, drop messages about products and collect orders on WhatsApp. However, it was not consistent. Some weeks I was able to do it all; some weeks I could not.”

He was looking for a more organised way of home deliveries and was approached by the Kiko.live and ONDC team. Since there were no upfront charges or fees and ONDC also helped with logistics for deliveries to farther areas, Bhatti joined the platform.

“In the first week of joining the platform, I had no customers. Then the Kiko.live team asked me to do some advertising on my own and inform my current customers and localities about this. I saw a significant increase in orders in about 35 days of enrolment. For nearby orders, I have my staff who does the delivery. For farther areas, ONDC helps with logistics,” he said.

With Kiko.live, Bhatti got the whole training and handholding to set up his store on the platform. Alok Chawla, Co-founder and CEO of Kiko.Live, explained that they help these kirana stores from end to end. Right from setting up their online stores and their inventory management to training them on how they can process orders online and make deliveries in 30 minutes via ONDC instead of the unreliable phone WhatsApp system.

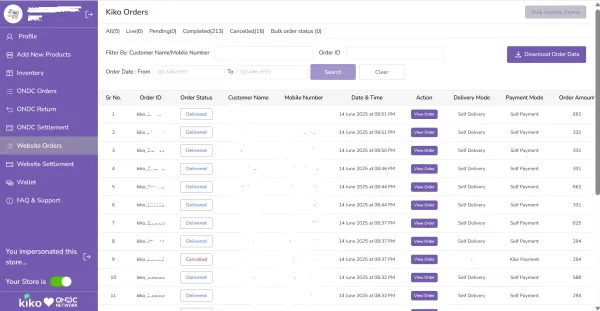

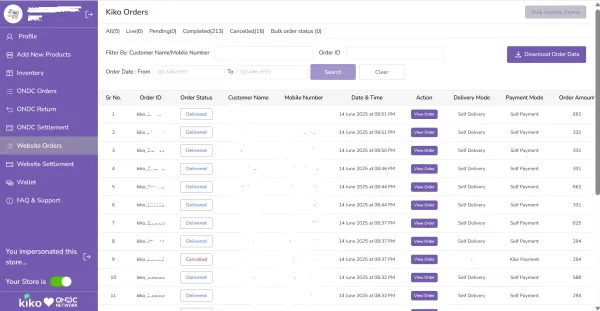

“They get all the information—who is ordering, how much is the total amount, is it cash-on-delivery? Or is it through a pay-later option or pay at the end of the month? At the end of the month, the seller and the customer both get a full detailed break-up of what you ordered and how much the customer owes,” he said, adding that there is no need to keep a manual track.

ONDC gets orders from various other platforms such as PayTm. Kiko.live has so far helped over 1000 kirana stores to sign up on ONDC and have access to more than 50,000 stores on the platform. They are currently processing around 5,000 orders a day in Delhi-NCR.

Chawla explained that a large chunk of the business comes from the seller’s own customer base. He said that the sellers are just migrating them from unorganised ordering to organised ones.

“About anywhere between 10% and 15% of every kirana store’s business comes from home deliveries, via WhatsApp or phone calls. We are helping the retailers migrate that 10-15% of their existing business to their online store. It's a better experience for your customers, and in the long term, these are the orders that you could potentially lose to the dark store with quick commerce,” he said, adding that the complete migration of these customers could take about 6-8 months.

The platform provides two kinds of deliveries—self and network delivery. As per Chawla, most sellers opt for self-delivery, as most orders are less than half a kilometre away and can be fulfilled by a delivery boy from the shop.

“About less than 5% of the orders right now are those which are a little further away, where the retailers choose network delivery via ONDC network logistics. The cost here is typically between Rs 20-25 for a 1-2 km delivery,” he said.

Another example is that of Pincode, a hyperlocal quick commerce app by PhonePe, which partners with local brick-and-mortar stores to provide quick deliveries. Present in more than 1,000 stores across cities like Pune, Bengaluru, Delhi-NCR, Hyderabad, Mumbai, and Varanasi to provide the technology, operational know-how, customer access, and logistics support they need.

Another example is that of Pincode, a hyperlocal quick commerce app by PhonePe, which partners with local brick-and-mortar stores to provide quick deliveries. Present in more than 1,000 stores across cities like Pune, Bengaluru, Delhi-NCR, Hyderabad, Mumbai, and Varanasi to provide the technology, operational know-how, customer access, and logistics support they need.

Vivek Lohcheb, CEO of Pincode, claimed that since onboarding with Pincode, most of the offline stores have witnessed more than 100% growth in their business. “Kirana or offline stores are incredibly agile. Many store owners are already using digital payment tools and messaging tools to engage with customers. What they lacked was a simple and efficient platform that could plug them into demand generation at scale—and that’s what Pincode offers. Our on-ground teams work closely with store owners to guide them through the transition, and the response has been overwhelmingly positive,” he said.

Vocal for local

Talking about the rising demand for quick commerce among retailers, Chawla said that about 20-30% of sellers in any city are worried about business going down and want to go online. They often look for low-cost options to set up an online store for quick delivery.

“The sellers tried to figure out with some other software companies that if I paid for my own website, what would it cost? And they really can’t afford it. But if you tell them there is zero investment up front, they jump at it. Today, we have a waitlist of about 8,000-plus stores that want to go online,” he said, adding that it takes about 7-10 days to train a first-time online seller.

This training includes showing them how the panel works, best-selling practices, how to pack an order in 5 minutes so that it is out quickly, digital and physical marketing, designing pamphlets about the store and distributing them with neighbourhood newspapers, putting up canopies where they talk to customers and tell them that we are giving you a quick commerce service, etc.

Pincode, on the other hand, has been enabling these sellers with end-to-end digital enablement—from ERP set-up and stock management to digital storefronts—combined with operational expertise to help local retailers track demand, optimise inventory, and improve returns.

“Real-time customer insights empower retailers to adapt to the digital hyperlocal economy and maintain store footfalls. Demand generation strategies attract and retain customers, boosting sales and visibility. Pincode creates a level playing field, allowing local businesses to compete effectively in the fast-paced digital market,” he said.

Locheb, however, added that the challenges in this experience are around technological know-how, real-time inventory visibility and management, and adapting to new order patterns.

Locheb, however, added that the challenges in this experience are around technological know-how, real-time inventory visibility and management, and adapting to new order patterns.

“Many kirana stores operate with traditional stock-keeping methods, and fulfilling online orders efficiently requires a mindset shift. Infrastructure like barcode systems or digital cataloguing may be missing. However, with the right tools, handholding, and localised support, these hurdles are entirely surmountable—and we’re seeing that happen every day,” he said.

Verma believes that the broader understanding is clear—new-age quick commerce is here to stay. “Call it a tech disruptor or innovation, and local kirana stores will have to adapt to the ecosystem and ‘evolve’ accordingly wherever required. While algorithmic convenience (enjoyed by quick commerce platforms) is and will be a difficulty for kiranas, they can still match the game with ‘trust’ and ‘time’ quotients,” he said.

On World MSME Day, on June 27, 2025, ET Digital will also open registrations for its sixth edition of the ET MSME Awards 2025. The coveted award programme celebrates India’s top MSMEs for their achievements and contribution to the nation’s economic development.

Most of these quick commerce firms deliver directly from their dark stores, employing delivery executives, demand forecasting, data analytics and an easy-to-use mobile app for customers, advantages local kirana stores find hard to afford. As per a 2024 report by Datum, the market share of kirana stores in India’s retail market dropped to 92.6% in 2023 from 95% in 2018. This number is further projected to drop to 88.9% by 2028. The report also showed that 46% of quick commerce users have reduced buying from kirana stores. More than 82% of the buyers have shifted at least 1/4th of their purchases from kirana stores to quick commerce platforms.

It has now become equally important for kirana stores to step up and embrace the changing times. Swiggy Instamart employs a hybrid model for its dark stores while also collaborating with kirana stores; firms like Kiko.live and Pincode are helping kirana stores compete in the times of quick delivery.

Nilaya Varma, Co-founder at Primus Partners India, explained that Kirana stores across India are no longer passive spectators; they’re actively evolving into micro quick-commerce hubs. “Many have instituted home delivery, digital payments, WhatsApp-based ordering, and basic inventory apps to meet modern consumer expectations. The willingness and demand are real. According to a survey, over 80% of kirana owners now believe digitising is essential, and around 84% have already begun integrating tech, even if modestly, into their operations,” he said.

Kuldeep Bhatti, owner of an organic grocery store, Easypick-Farmfresh, in East Delhi, onboarded on ONDC (Open Network Digital Commerce) through Kiko.live in January 2024. ONDC is a government-backed digital commerce initiative that has been working with many private players to help local MSMEs and sellers with online selling.

Kuldeep Bhatti, owner of an organic grocery store, Easypick-Farmfresh, in East Delhi, onboarded on ONDC (Open Network Digital Commerce) through Kiko.live in January 2024 and has seen a 25-30% increase in revenue since then.

He had earlier tried to take orders through WhatsApp, but the process wasn’t structured. “What I did earlier was note down the numbers of all my customers, drop messages about products and collect orders on WhatsApp. However, it was not consistent. Some weeks I was able to do it all; some weeks I could not.”

He was looking for a more organised way of home deliveries and was approached by the Kiko.live and ONDC team. Since there were no upfront charges or fees and ONDC also helped with logistics for deliveries to farther areas, Bhatti joined the platform.

“In the first week of joining the platform, I had no customers. Then the Kiko.live team asked me to do some advertising on my own and inform my current customers and localities about this. I saw a significant increase in orders in about 35 days of enrolment. For nearby orders, I have my staff who does the delivery. For farther areas, ONDC helps with logistics,” he said.

With Kiko.live, Bhatti got the whole training and handholding to set up his store on the platform. Alok Chawla, Co-founder and CEO of Kiko.Live, explained that they help these kirana stores from end to end. Right from setting up their online stores and their inventory management to training them on how they can process orders online and make deliveries in 30 minutes via ONDC instead of the unreliable phone WhatsApp system.

“They get all the information—who is ordering, how much is the total amount, is it cash-on-delivery? Or is it through a pay-later option or pay at the end of the month? At the end of the month, the seller and the customer both get a full detailed break-up of what you ordered and how much the customer owes,” he said, adding that there is no need to keep a manual track.

ONDC gets orders from various other platforms such as PayTm. Kiko.live has so far helped over 1000 kirana stores to sign up on ONDC and have access to more than 50,000 stores on the platform. They are currently processing around 5,000 orders a day in Delhi-NCR.

Chawla explained that a large chunk of the business comes from the seller’s own customer base. He said that the sellers are just migrating them from unorganised ordering to organised ones.

“About anywhere between 10% and 15% of every kirana store’s business comes from home deliveries, via WhatsApp or phone calls. We are helping the retailers migrate that 10-15% of their existing business to their online store. It's a better experience for your customers, and in the long term, these are the orders that you could potentially lose to the dark store with quick commerce,” he said, adding that the complete migration of these customers could take about 6-8 months.

The platform provides two kinds of deliveries—self and network delivery. As per Chawla, most sellers opt for self-delivery, as most orders are less than half a kilometre away and can be fulfilled by a delivery boy from the shop.

“About less than 5% of the orders right now are those which are a little further away, where the retailers choose network delivery via ONDC network logistics. The cost here is typically between Rs 20-25 for a 1-2 km delivery,” he said.

Kiko.live's dashboard for a seller, who is able to see information such as type of delivery-self or network, order and time, payment mode, inventory, return etc.,.

Vivek Lohcheb, CEO of Pincode, claimed that since onboarding with Pincode, most of the offline stores have witnessed more than 100% growth in their business. “Kirana or offline stores are incredibly agile. Many store owners are already using digital payment tools and messaging tools to engage with customers. What they lacked was a simple and efficient platform that could plug them into demand generation at scale—and that’s what Pincode offers. Our on-ground teams work closely with store owners to guide them through the transition, and the response has been overwhelmingly positive,” he said.

Vocal for local

Talking about the rising demand for quick commerce among retailers, Chawla said that about 20-30% of sellers in any city are worried about business going down and want to go online. They often look for low-cost options to set up an online store for quick delivery.

“The sellers tried to figure out with some other software companies that if I paid for my own website, what would it cost? And they really can’t afford it. But if you tell them there is zero investment up front, they jump at it. Today, we have a waitlist of about 8,000-plus stores that want to go online,” he said, adding that it takes about 7-10 days to train a first-time online seller.

This training includes showing them how the panel works, best-selling practices, how to pack an order in 5 minutes so that it is out quickly, digital and physical marketing, designing pamphlets about the store and distributing them with neighbourhood newspapers, putting up canopies where they talk to customers and tell them that we are giving you a quick commerce service, etc.

Pincode, on the other hand, has been enabling these sellers with end-to-end digital enablement—from ERP set-up and stock management to digital storefronts—combined with operational expertise to help local retailers track demand, optimise inventory, and improve returns.

“Real-time customer insights empower retailers to adapt to the digital hyperlocal economy and maintain store footfalls. Demand generation strategies attract and retain customers, boosting sales and visibility. Pincode creates a level playing field, allowing local businesses to compete effectively in the fast-paced digital market,” he said.

Vivek Lohcheb, CEO of Pincode, claimed that since onboarding with Pincode, most of the offline stores have witnessed more than 100% growth in their business.

“Many kirana stores operate with traditional stock-keeping methods, and fulfilling online orders efficiently requires a mindset shift. Infrastructure like barcode systems or digital cataloguing may be missing. However, with the right tools, handholding, and localised support, these hurdles are entirely surmountable—and we’re seeing that happen every day,” he said.

Verma believes that the broader understanding is clear—new-age quick commerce is here to stay. “Call it a tech disruptor or innovation, and local kirana stores will have to adapt to the ecosystem and ‘evolve’ accordingly wherever required. While algorithmic convenience (enjoyed by quick commerce platforms) is and will be a difficulty for kiranas, they can still match the game with ‘trust’ and ‘time’ quotients,” he said.

On World MSME Day, on June 27, 2025, ET Digital will also open registrations for its sixth edition of the ET MSME Awards 2025. The coveted award programme celebrates India’s top MSMEs for their achievements and contribution to the nation’s economic development.