Yes Bank Share Price On Friday, June 27, 2025, the 30 -share BSE Sensex rose by 321.04 points or 0.38 per cent to 84076.91 points and NSE Nifty reached 92.30 points or 0.36 per cent at the level of 25641.30 points.

On Friday, June 27, 2025, the share of the Sensex-Nifty is trading the share of Yes Bank Limited Company at Rs 20.21. Previous Closing is trading up a gain of 0.64 percent from the level of Rs 20.08. Let us know that Yes Bank Company Share has given negative returns of -14.04% percent to investors in the last one year.

Today, on Friday, 27 June 2025, the stock of Yes Bank Limited Company is trading at Rs 20.21 with a gain of 0.64 per cent. The existing data shows that, on Friday morning, trading in the stock market started, Yes Bank Share opened at Rs 20.1. This afternoon, YAS Bank Company Share touched a high level of Rs 20.49 for the day by 3.10 PM. At the same time, the low-level of the stock on Friday was Rs 20.1.

Friday, June 27.25 – This bank share readtst States

Today on Friday, 27 June 2025, the highest level of 52-week of Yes Bank Limited Company Share is Rs 27.44. Whereas, the 52 weeks of Yes Bank share is Rs 16.02. Yes Bank Stock slipped from a high level of its 52 -week -26.35 percent. At the same time, the stock has recorded a rise of 26.15 percent from the lower level of 52-week. According to data available on NSE-BSE up to 3.10 pm on Friday, 27 June 2025, Yes Bank Company had a turnover of 9,63,80,658 shares per day during the last 30 days.

Today on Friday, 27 June 2025, the total market cap of Yes Bank Company 63,666 CR. It is Rs. The same PE Resho of Yes Bank Limited Company is 26.0. Till today, Yes Bank Company has a loan of Rs 3,56,391 CR.

Yes Bank share price range till Friday, 27 June 2025

Yes Bank shares are trading up a boom at Rs 20.21 on Friday as against the previous closing price of Rs 20.08. Today on Friday, 27 June 2025, till 3.10 pm, Yes Bank Company shares are trading in the range of Rs 20.10 – 20.49.

This bank stock technical

From a technical point of view, the Relative Strength Index (RSI) of Yes Bank shares is at 49.8, showing that the shares have neither been purchased nor sold more. Yes Bank shares are trending above 5 days, 10 days, 50 days, 100 days, 150 days, 200 days of Moving average, but 20 days and 30 days are below the average.

What did the Bonanja broking firm say?

Kunal Kamble, Senior Technical Research analyst of Bonanja Broking Firm said, “Yes Bank is currently making a lower, lower high structure, which continues to show the dowstrend. However, the stock recently broke over a Flying Trendline, but it could not make the breakout, because it could not buck the price again, because the sale pressure again

To resume the Bulish Momentum, the stock must be decisively closed above Rs 23.40. Till then, freshness should be avoided by new entry as the trend is weak. At the bottom, the brake below Rs 17.40 can open the doors towards Rs 15.98 for further decline.

What did Choice Broking Experts say?

What did the Choice Broking Senior Equity Research Analyst Mandar Bhojne say, “YES Bank is currently trading at ₹ 20.06, showing a sideways trend between ₹ 20.45 to ₹ 19.30, which depicts individual and neutral sentiments. RSI is supporting the moving stages, which is supporting the moving stage. The 20-week EMA is above the EMA and is taking support close to the 200-day EMA, which reflects the underling strength.

If it breaks below ₹ 19.50, it can pull the stock towards ₹ 18.00 level, which can become a strong support area. At the top, a decisive move above ₹ 20.50 can trigger a bullish reversal with volume confirmation, which can open the path towards a large target for ₹ 22.50- ₹ 25.00.

Breakout or breakdown signals should be seen

Given the setup of now, taking a long position around Rs 20.06 can be considered and the stop-loss should be set to Rs 19.30. Traders should see a breakout or breakdown signals, which are supported by volume or bullish/bearish candlestick patterns to detect the direction.

What did SEBI registered analyst Ar Ramachandran say?

SEBI registered analyst Ar Ramachandran says, “YES Bank has a slight bull on the stock price daily chart, and its strong support is at Rs 19.62. If it closes the daily resistance of Rs 20.55, we can soon see the target of Rs 23.

What did Goldman Sachs Broking firm say?

The Goldman Sachs broking firm has given a ‘Sell’ call on YES Bank. Its price target is Rs 15 per share. This global brokerage said that they are hoping that banks will give 14% loan growth and 3 basis points on assets during FY25-27.

Yes Bank Stock Share Target Price

Today, on Friday, 27 June 2025, according to the update from Dalal Street, Choice Broking Firm has set a target price of Rs 25 on Yes Bank Stock. Yes Bank Share is currently trading at a price of Rs 20.21. Overall, the Choice Broking Firm expects an upset of 23.70 percent from the stock. Experts have rated the Hold on Yes Bank Share.

How much return did Yes Bank share give till Friday, 27 June 2025?

Today, on Friday, 27 June 2025, during the last 1 year, Yes Bank stock has fallen by -14.04 per cent, while 3 years have seen a rise of 57.28 per cent. At the same time, Yes Bank shares have fallen by -24.45 percent in the last 5 years period and the stock of Yes Bank has risen to 3.16 percent on a year-on-year basis (YTD) basis.

-

Mega blast will be revealed on August 15, new platform will be revealed

-

How Shamar Joseph’s Spell Exposed Australia’s Fragile Top Order:

-

Cricket News: Karun Nair’s ‘flop show’ in England, did not Shreyas Iyer choose a big mistake

-

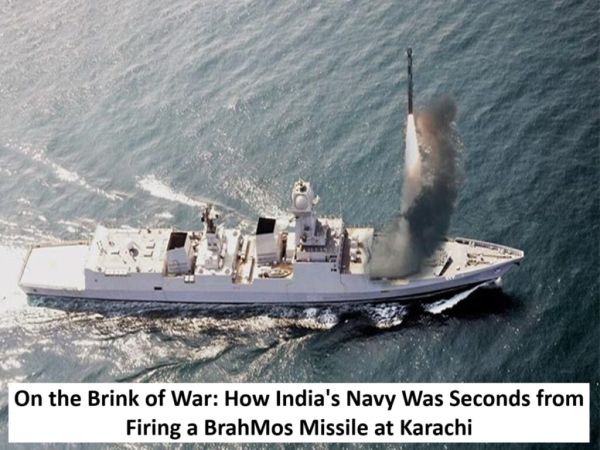

How India’s Navy Was Seconds from Firing a BrahMos Missile at Karachi:

-

8th Pay Commission: Net salary on grade-pay of Level-1, 2, 3, 4, 5, 6, 7?