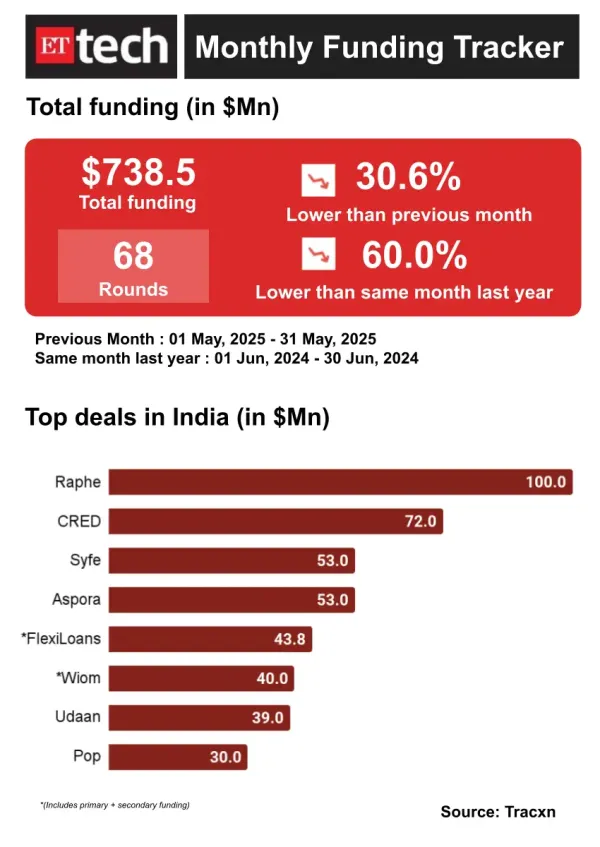

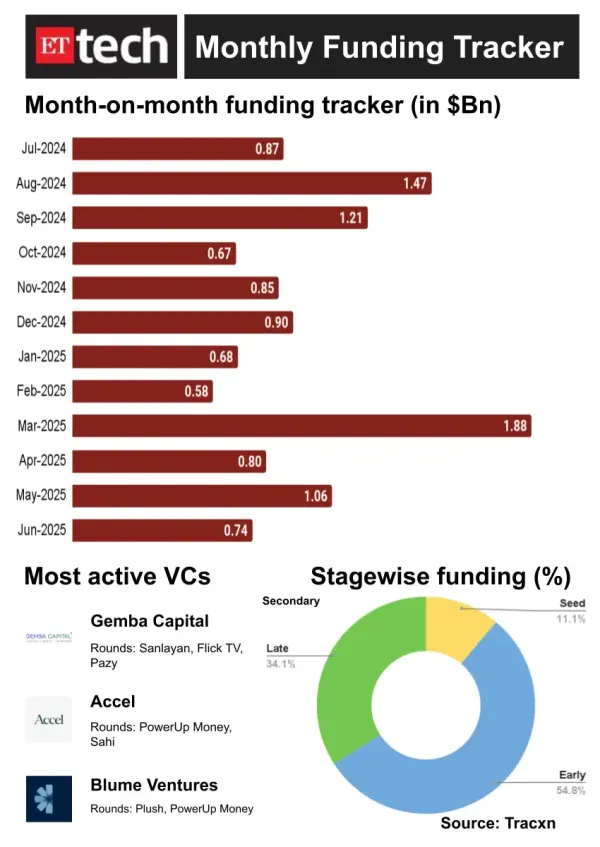

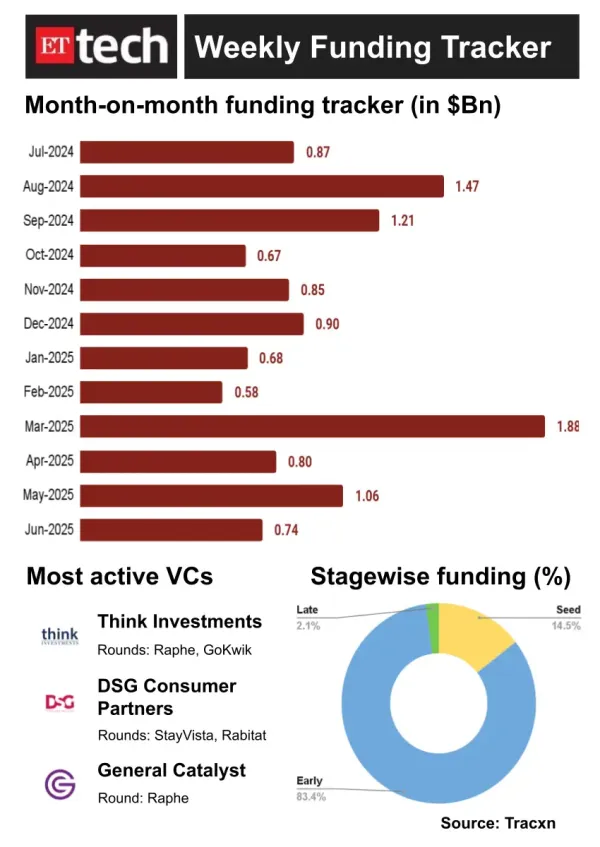

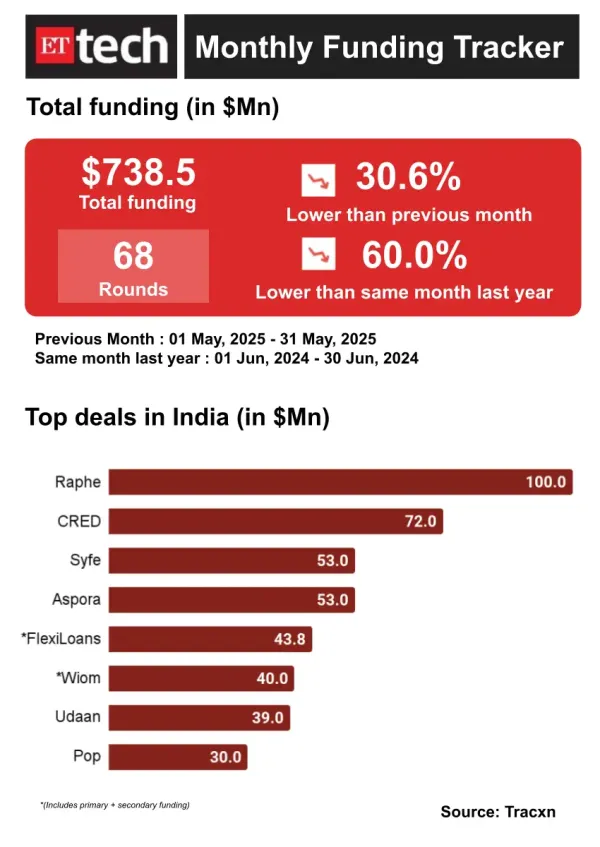

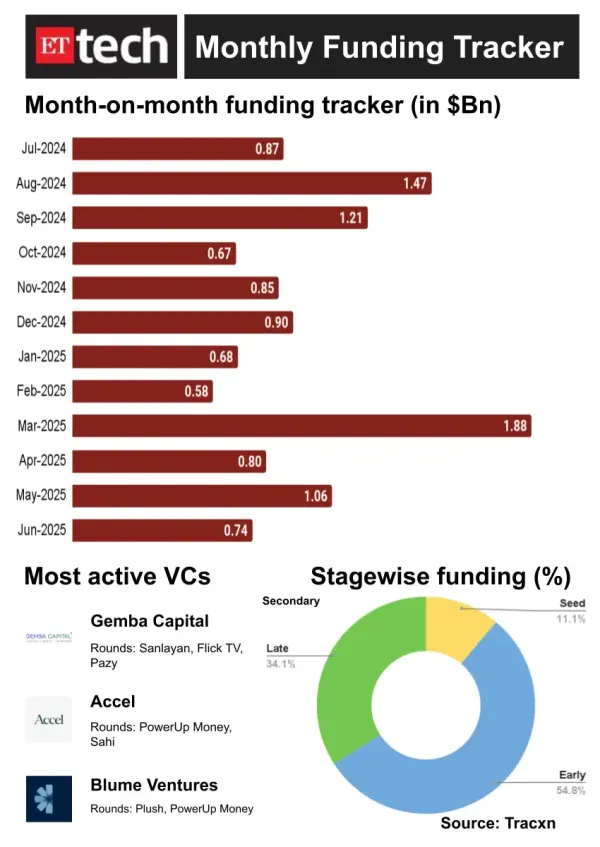

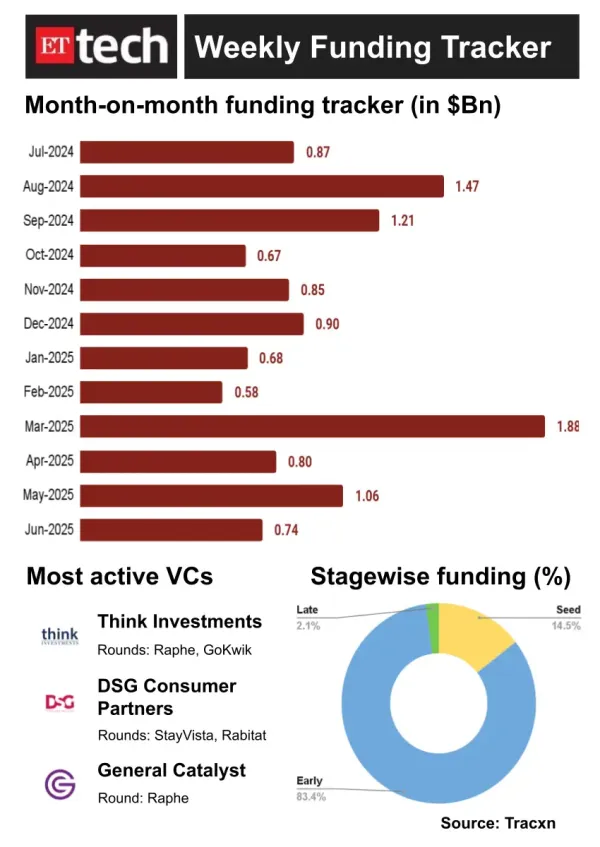

Indian startups raised about $738.5 million in funding between June 1 and 27, marking a 60% decrease from the full month last year, when they had raised a total of $1.8 billion across 207 rounds.

This month, startups, primarily in the seed, early and late stages, secured funding through 68 rounds, according to data from market intelligence platform Tracxn.

In May 2025, startups raised around $1.06 billion from 79 rounds.

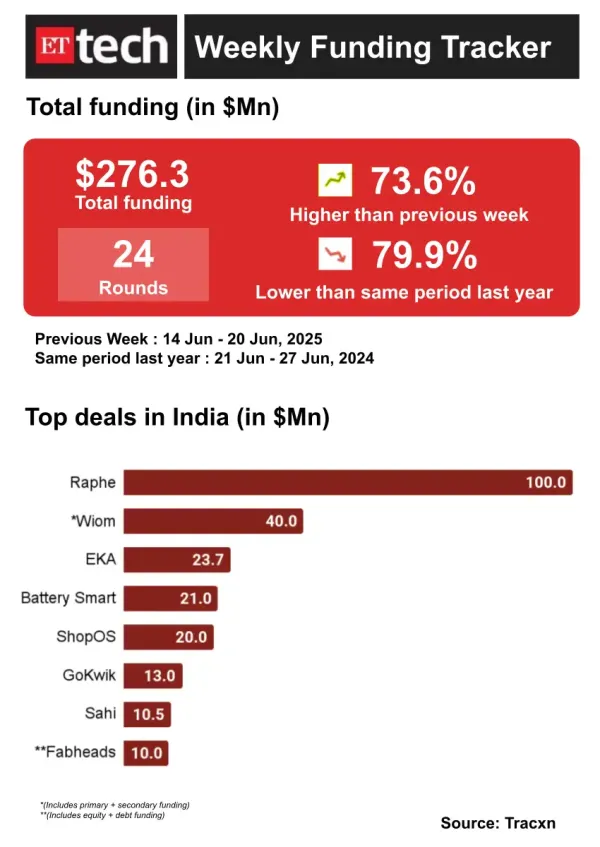

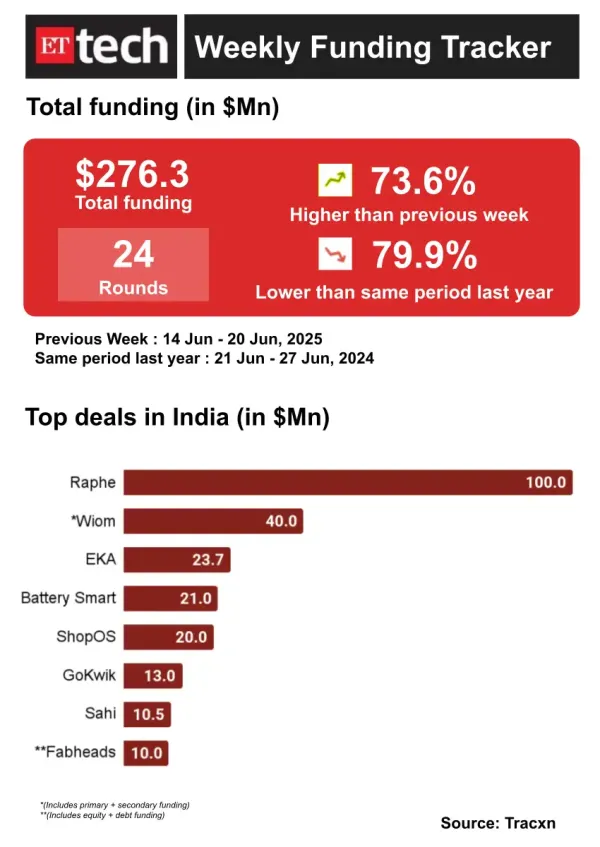

Last week — from June 21 to June 27 — startups raised around $276.3 million.

Top deals of the month

Raphe mPhibr: Noida-based drone manufacturing startup Raphe mPhibr raised $100 million in an equity funding round led by Silicon Valley investor General Catalyst. The round also saw participation from existing investors, including stock market investor Amal Parikh, Think Investments, and other family offices.

Cred: Fintech firm Cred closed a funding round of about $72 million at a sharply reduced valuation of $3.5 billion. This marks a steep 45% cut from the $6.4 billion valuation at which the company last raised capital in 2022. Singapore’s sovereign wealth fund GIC, through its investment arm Lathe Investment, led the funding.

Syfe: The Singapore-based wealth management platform raised $53 million in a fresh funding round, led by two UK-based family offices. In August 2024, the company had raised $27 million as part of the same round, and this extension takes the total funds raised in the round to $80 million.

Aspora: Y Combinator-backed cross-border payments startup Aspora raised $53 million in Series B funding, co-led by Sequoia and Greylock, with Quantum Light Ventures also contributing to the round.

Flexiloans: New-age non-banking finance company (NBFC) Flexiloans raised around $43.8 million in a mix of primary and secondary capital. The round was led by existing investors Nandan Nilekani’s Fundamentum, US-based impact investor Accion Digital Transformation, American asset management firm Nuveen, and Denmark-based asset management major Maj Invest.

Also Read: India ranks third globally in tech startup funding despite slowdown: Tracxn

This month, startups, primarily in the seed, early and late stages, secured funding through 68 rounds, according to data from market intelligence platform Tracxn.

In May 2025, startups raised around $1.06 billion from 79 rounds.

Last week — from June 21 to June 27 — startups raised around $276.3 million.

Top deals of the month

Raphe mPhibr: Noida-based drone manufacturing startup Raphe mPhibr raised $100 million in an equity funding round led by Silicon Valley investor General Catalyst. The round also saw participation from existing investors, including stock market investor Amal Parikh, Think Investments, and other family offices.

Cred: Fintech firm Cred closed a funding round of about $72 million at a sharply reduced valuation of $3.5 billion. This marks a steep 45% cut from the $6.4 billion valuation at which the company last raised capital in 2022. Singapore’s sovereign wealth fund GIC, through its investment arm Lathe Investment, led the funding.

Syfe: The Singapore-based wealth management platform raised $53 million in a fresh funding round, led by two UK-based family offices. In August 2024, the company had raised $27 million as part of the same round, and this extension takes the total funds raised in the round to $80 million.

Aspora: Y Combinator-backed cross-border payments startup Aspora raised $53 million in Series B funding, co-led by Sequoia and Greylock, with Quantum Light Ventures also contributing to the round.

Flexiloans: New-age non-banking finance company (NBFC) Flexiloans raised around $43.8 million in a mix of primary and secondary capital. The round was led by existing investors Nandan Nilekani’s Fundamentum, US-based impact investor Accion Digital Transformation, American asset management firm Nuveen, and Denmark-based asset management major Maj Invest.

Also Read: India ranks third globally in tech startup funding despite slowdown: Tracxn