As the income tax return (ITR) filing season gets underway, salaried individuals must equip themselves with the right knowledge and documentation to ensure accurate and timely compliance. With the deadline for filing income tax returns fast approaching, salaried taxpayers are sifting through financial records and TDS certificates to meet their obligations. While the process may appear routine, tax experts advise that the choice of the correct ITR form and tax regime could significantly affect the outcome of one’s filing.

Here are some of the essential aspects to keep in mind before filing your return this year:

Selection Of Tax Regime: New Vs Old

Salaried individuals can choose between the new and old tax regimes based on their income structure and eligible deductions. However, if opting for the old regime, it is mandatory to notify the employer in advance; otherwise, the default selection will be the new regime.

Form 16

The employer issues Form 16 and provides a comprehensive summary of the salary paid and the tax deducted at source (TDS). It is a crucial document for any salaried taxpayer.

Cross-Verify With Form 26AS

Form 26AS serves as a tax passbook reflecting all TDS and tax collected at source (TCS) against a PAN. Taxpayers should ensure the figures in Form 16 match those in Form 26AS to avoid discrepancies.

Investments Beyond Tax Benefits

Not all investments need to be tax-motivated. Financial instruments such as the Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificates (NSC), and Kisan Vikas Patra (KVP) offer long-term wealth creation benefits, regardless of tax deductions.

House Rent Allowance (HRA)

If you are eligible for a substantial HRA exemption, it may be more beneficial to file under the old tax regime. Those who aren’t eligible may consider the new regime, which offers lower tax rates but fewer deductions.

Stock Market Investments Call For ITR-2

Salaried individuals who have earned capital gains from equities or mutual funds should opt for ITR-2 instead of ITR-1. This form is designed to accommodate such additional income.

Reporting Income From Multiple House Properties

If you have income from more than one house property, ITR-2 becomes mandatory. For income from a single property along with salary, ITR-1 suffices.

-

There is a panacea in diabetes! Know how blood sugar control does

-

A Soundtrack for Life’s Highs and Lows:

-

Learn what is TRAI’s pilot project, how to get rid of commercial calls

-

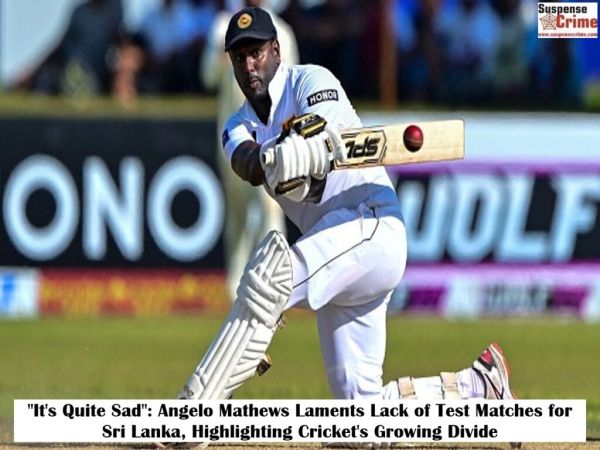

Angelo Mathews Laments Lack of Test Matches for Sri Lanka, Highlighting Cricket’s Growing Divide:

-

Yograj Singh said that the reason for Bumrah’s repeated injury, said- do not do this before this age