New Delhi:The initial share sale of Arisinfra Solutions Ltd received a 24 per cent subscription on the first day of bidding on Wednesday.

The Initial Public Offer (IPO) got bids for 31,78,815 shares against 1,30,84,656 shares on offer, as per NSE data.

The category for Retail Individual Investors (RIIs) got fully subscribed by 1.04 times. The quota for non-institutional investors received 19 per cent subscription.

ArisInfra Solutions Ltd on Tuesday said it has garnered Rs 225 crore from anchor investors.

The nearly Rs 500-crore IPO will conclude on June 20. The price band for the offer has been fixed at Rs 210 to Rs 222 per share.

The IPO is completely a fresh issue of equity shares worth Rs 499.6 crore with no offer for sale (OFS) component.

At the upper end of the price band, the company is valued at nearly Rs 1,800 crore.

Proceeds of the issue will be used for funding the working capital requirements of the company, investment in the subsidiary, Buildmex-Infra, for funding its working capital, purchase of partial shareholding from existing shareholders of its subsidiary, ArisUnitern Re Solutions Pvt Ltd, repayment of loan and for general corporate purposes.

Arisinfra Solutions is a B2B technology-enabled company, focusing on simplifying and digitizing the procurement process for construction materials.

JM Financial, IIFL Capital Services and Nuvama Wealth Management are the book running lead managers to the issue.

Disclaimer: This story is from the syndicated feed. Nothing has been changed except the headline.

-

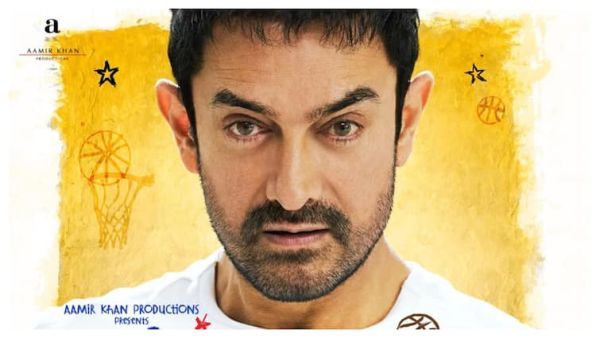

Sitaare Zameen Par Box Office Prediction: Aamir Khan Eyes ₹30 Cr Weekend—Only If Word Of Mouth Clicks

-

Why Sitaare Zameen Par Could Be Aamir Khan’s Most Unexpected Hit

-

Celina Jaitly Recalls A Rare Pregnancy Illness That Nearly Took Her Twins

-

FASTag annual pass is not valid for two expressways, one is Meerut Expressway, other is…; how will 200 trips be counted in Rs 3000, know calculation here

-

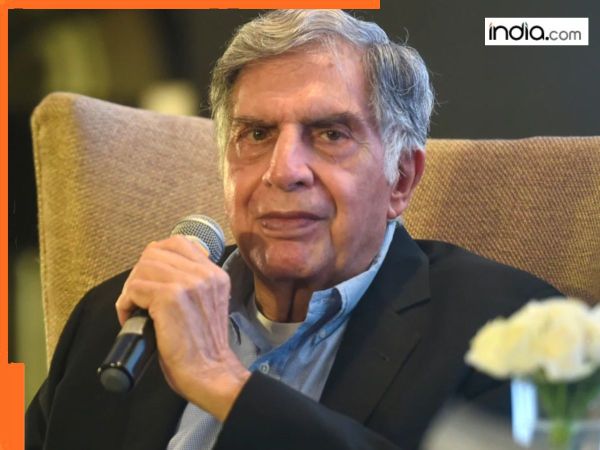

Bad news for Ratan Tata’s group TCS as it faces strong opposition from…