The long-awaited initial public offering (IPO) of the National Stock Exchange (NSE) may be closer than ever, with SEBI Chairman Tuhin Kanta Pandey reiterating that there are no regulatory impediments holding it back. Speaking at the CFO Awards event in Mumbai, Pandey remarked, “I have said before that there is no obstacle that will remain in case of NSE-IPO.”

His statement signals renewed momentum in the ongoing discussions between the Securities and Exchange Board of India (SEBI) and the NSE regarding the exchange’s IPO, which has been pending for several years.

Clarifying a key technical concern, Pandey dismissed the notion that the demerger of clearing corporations could delay the IPO process. “That particular thing is not really an obstacle in terms of an IPO process,” he said. According to Pandey, the recent consultation paper on this matter only reflects the regulator’s initial position and does not represent a finalized policy, as per a Moneycontrol report.

He added that NSE is actively working to resolve several issues ahead of the IPO filing. “I think they are settling out all those things that are there. There is some legal settlement and other things, and some amount will have to be paid, and that cases would have to be withdrawn, and so on,” Pandey noted.

Co-location Case Settlement May Unlock IPO Path

Sources in the report indicate that SEBI and NSE are in advanced stages of negotiation regarding the settlement of the co-location case, a key regulatory hurdle before NSE can receive the No Objection Certificate (NOC) needed for its IPO application. The case involved allegations that some brokers gained unfair access to trading data by placing their servers in close physical proximity to NSE’s systems.

In a letter dated March 28, NSE expressed its willingness to resolve outstanding matters: “NSE is keen to resolve all pending matters amicably through settlement mechanism, as available and appropriate.” The exchange’s governing board has already approved the proposal, and a previous letter dated August 27, 2023, requested a consolidated settlement of all open issues.

SAT’s Relief To NSE In 2023

The co-location controversy dates back to SEBI’s 2019 order, which directed NSE to disgorge Rs 625 crore with interest for violations linked to unfair trading access. However, the SAT later found that NSE did not commit fraud and that SEBI’s demand for disgorgement was excessive. It observed that the issue was primarily one of partial non-compliance with a circular, rather than a breach of law.

The resolution of this case is expected to be a pivotal step in clearing the way for India’s largest stock exchange to finally go public.

-

Acharya Prashant redefines yoga through Bhagavad Gita in cinema halls across India

-

[WATCH] MPL 2025: Vicky Ostwal survives run-out despite nasty collision mid-pitch in Eliminator

-

BTS Member Suga Completes Military Service and Reflects on Past Controversies

-

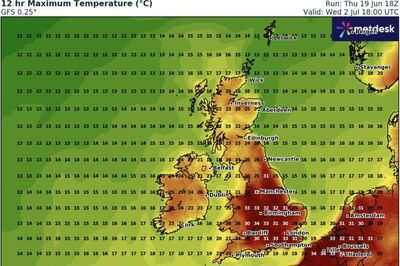

UK weather: Second heatwave could send temperatures to 39C as maps reveal date

-

Thalapathy Vijay turns a year Bolder! Catch his Biggest Hits on Tata Play Binge!