Loans often prove to be helpful in very important work, no matter what kind of loan it is. In such a situation, you need to know how your credit score is? A good credit score plays an important role in maintaining your trust and confidence with lenders. Along with this, a good credit score shows your financial discipline, which proves to be helpful if you ever have to take an emergency loan. Along with this, a good credit score helps you get a loan on better terms and at lower interest rates.

Repeated credit card inquiries reduce the chances of loan approval

If you have taken a loan more than once in a short period of time, then repeated inquiries related to loan or credit card can have a direct negative impact on your credit score. Experts warn that repeated inquiries related to loan can affect the credit score and in many cases the possibility of loan approval may be reduced.

How does the credit score fall?

Regarding the fall in the credit score, financial experts say that when inquiries are initiated by lenders, then many hard inquiries in a short period of time can cause problems for the lenders. This inquiry indicates that the person is more dependent on credit or is facing some financial problem.

How to avoid credit score impact?

Now the question arises that how to avoid the impact of credit card score? To avoid this impact, one should avoid not only applying for a credit card but also applying for many loans in a short time. You can also check your credit score by doing a soft inquiry. For this soft inquiry, instead of contacting the lenders, try to check it directly using a reliable platform.

-

How to submit your Arji to Khatu Shyam Ji without visiting the temple

-

From glowing skin to weight loss, juice of this thing with carrots is no less than a miracle

-

Consuming these 6 fruits will eliminate stains, will improve the skin

-

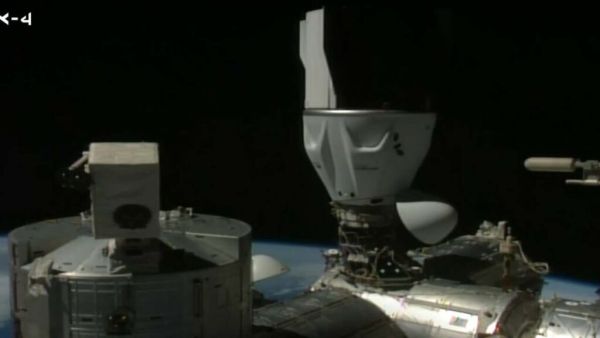

Group Captain Shubhanshu Shukla created history, the first Indian to reach ISS

-

Vivo X200 Fe Launching Official Confirm in India; Microsite is also live