Reliance Industries shares rose nearly 2% on Thursday pushing its market valuation back above the Rs 20 lakh crore milestone. The stock gained 1.90% to close at Rs 1495.20 on the BSE after reaching an intraday high of Rs 1498.70 marking a 2.14% increase during the session. At the NSE it rallied 1.90 per cent to Rs 1495.30. Tracking a rally in the stock the companys market valuation surged by Rs 37837.9 crore to Rs 2023375.31 crore. Rally in the blue-chip stock was instrumental in driving the equity markets higher. The 30-share BSE Sensex jumped 1000.36 points or 1.21 per cent to settle at 83755.87. The 50-share NSE Nifty rallied 304.25 points or 1.21 per cent to 25549. Reliance Industries Ltd Mcap Reliance Industries Ltd (RIL) had on February 13 last year became the first Indian company to achieve a market capitalisation of Rs 20 lakh crore. The company is the most valuable domestic firm in terms of market valuation followed by HDFC Bank with a market capitalisation of Rs 1551218.93 crore Tata Consultancy Services (Rs 1245219.09 crore) Bharti Airtel (Rs 1148518.05 crore) and ICICI Bank (Rs 1027838.79 crore) in the top five order. So far this year Reliance shares have jumped 23 per cent. Stock Market Closing Bell Equity benchmark indices Sensex and Nifty surged over 1 per cent on Thursday taking their winning momentum to the third day running amid growing optimism following easing geopolitical tensions and buying in market heavyweights HDFC Bank and Reliance Industries. The 30-share BSE Sensex jumped 1000.36 points or 1.21 per cent to settle at 83755.87. During the day it surged 1056.58 points or 1.27 per cent to 83812.09. The 50-share NSE Nifty rallied 304.25 points or 1.21 per cent to 25549. From the Sensex constituents Tata Steel Bajaj Finance Bharti Airtel Adani Ports Eternal Bajaj Finserv NTPC HDFC Bank Reliance Industries and Axis Bank were among the major gainers. (With Inputs From PTI)

-

How to submit your Arji to Khatu Shyam Ji without visiting the temple

-

From glowing skin to weight loss, juice of this thing with carrots is no less than a miracle

-

Consuming these 6 fruits will eliminate stains, will improve the skin

-

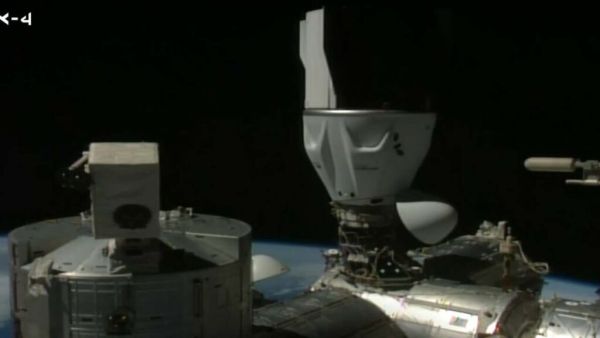

Group Captain Shubhanshu Shukla created history, the first Indian to reach ISS

-

Vivo X200 Fe Launching Official Confirm in India; Microsite is also live