Income Tax: The month of July will start soon and with this, the deadline for filing ITR is also coming closer.

If you are also thinking of filing an ITR for 2024-2025, then in this news we are going to tell you about 8 such documents, after which you will not even need a CA to fill ITR (ITR filing documents). Let us know about these 8 documents in the news.

1- Know what is Form 16

First of all, let us tell you that Form-16 (Form-16 kya hai) is a very important document for employed people. This document contains complete information about salary and tax deducted.

2- What will be the TDS certificates

Along with this, it is very important to have all the certificates like Form 16A, Form 16B, Form 16C, and Form 16D to fill ITR, which contains information about TDS.

3- What is Capital Gain Statement

Wheat Rate Hike: Wheat prices set a record, the price of 1 quintal has become this much

Along with this, if you have sold shares or mutual funds, then definitely take the statement from the broker or fund house. Let us tell you that it is also very important for you to have a Capital Gain Statement.

4- Benefits of AIS and Form 26AS

Whenever you are filling out ITR (ITR Filling Tips), download AIS and Form 26AS from the Income Tax website, it contains complete information about income, tax, and expenses.

5- Information about foreign income and unlisted shares

Apart from this, if you have shares of a foreign company or foreign bank accounts, then its information should also be filed in ITR. For this reason, it is very important to have the documents related to it (Unlisted share documents).

6- Certificate of interest and bank statement

If you deposit money in banks or post offices, then you should take the interest certificate related to it. Apart from this, download the bank statement as well.

7- Documents of expenses are also important

Along with this, if you fill ITR in the old tax system, then keep the documents of investment and expenses under sections 80C, 80D, etc.

8- Information about PAN, Aadhaar, and bank account

If you are filling out ITR (ITR Filling Tips), then your PAN-Aadhaar should be linked while filling out ITR. Along with this, keep all the bank account details ready, because these details will be required while filing ITR.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

How to submit your Arji to Khatu Shyam Ji without visiting the temple

-

From glowing skin to weight loss, juice of this thing with carrots is no less than a miracle

-

Consuming these 6 fruits will eliminate stains, will improve the skin

-

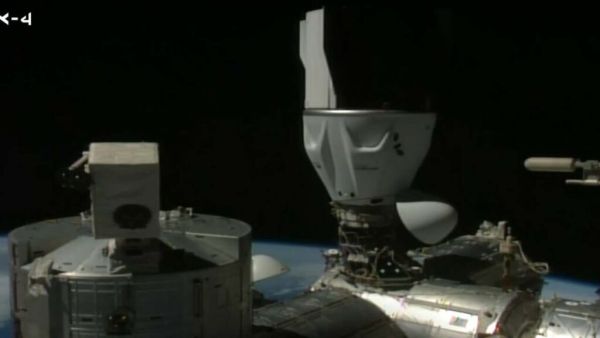

Group Captain Shubhanshu Shukla created history, the first Indian to reach ISS

-

Vivo X200 Fe Launching Official Confirm in India; Microsite is also live